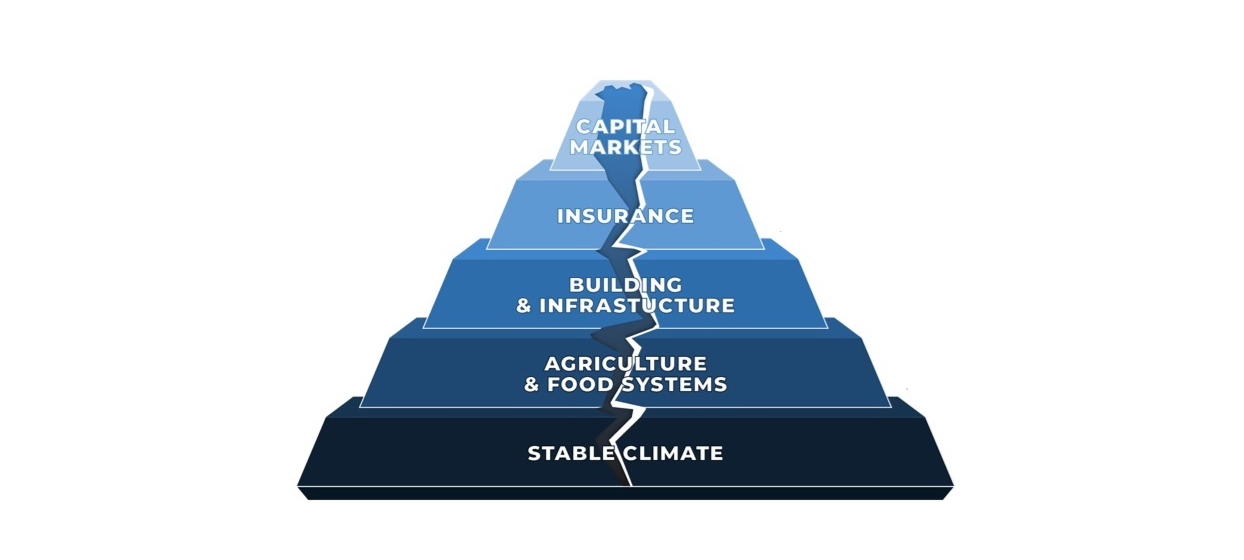

As the climate becomes less stable, we believe it will lead to a reshuffling of the entire system, starting with the most vulnerable sectors:

- Insurance markets begin to crack, as we are now witnessing across the country, as insurers pull out of high-risk areas and drive-up premiums, even in unaffected areas, to cover their losses. And as reinsurance markets re-price risk, it becomes more expensive or impossible to insure property in flood zones, wildfire regions, and coastal areas.

- Agriculture becomes unstable, as we are also now witnessing, as crops depend on predictable seasons, rainfall, and temperature ranges. As climate volatility continues to cause droughts, floods, fires, and other extreme weather events, food supply chains are disrupted, and prices are driven higher. This doesn’t just impact food production, it also affects entire economies, trade networks, and inflation levels.

- The capital markets will need to adjust to these changes. As insurance becomes more expensive, or unavailable, and property values decline in high-risk areas, wider financial impacts are triggered on mortgage markets and real estate-backed securities. In addition, companies in affected regions will struggle with higher costs and capital constraints, leading to repricing in the stock and bond markets.

All of these factors lead to what we believe is one unavoidable conclusion: capital will flow toward climate adaptation and resilience, and the markets will reward the companies that are best positioned to respond to the structural shift that is taking place.

Climate adaptation and resilience is already happening, as insurance markets are already repricing risk, infrastructure is needing to be rebuilt, and businesses are continually adjusting to new climate realities. We strongly believe that the time to position capital is now, before these themes become mainstream and valuations rise. Would you like to learn more?

Schedule a Consultation

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risks associated therewith and any related legal, tax, accounting or other material considerations. To the extent that the reader has any questions regarding the applicability of any specific issue discussed above to their specific portfolio or situation, prospective investors are encouraged to contact Gitterman Asset Management or consult with the professional advisor of their choosing.

Certain information contained herein has been obtained from third party sources and such information has not been independently verified by Gitterman. No representation, warranty, or undertaking, expressed or implied, is given to the accuracy or completeness of such information by Gitterman or any other person. While such sources are believed to be reliable, Gitterman does not assume any responsibility for the accuracy or completeness of such information. Gitterman does not undertake any obligation to update the information contained herein as of any future date.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

The information set forth herein is intended to be informational in nature and is not intended to be, and should not be construed as, investment advice. This information is accurate as of the above-listed date and it should not be assumed that it will remain the same over time.